This is a very convenient moment to put up this post. Alan Greenspan has just admitted that he's human like the rest of us, and that he doesn't have a very good explanation for why long-term interest rates have been falling at a time when he and his Fed colleagues have been busy raising short-term rates. I think he's being a bit coy here, since I'm sure he has some idea. Among other things he will be well aware of the contents of a speech made recently by Ben Bernanke, a US economist who is considered high on the list of possible Greenspan successors.

What Bernanke said in the speech ( The Global Savings Glut ) was this:

"Iwill argue that over the past decade a combination of diverse forces has created a significant increase in the global supply of saving--a global saving glut--which helps to explain both the increase in the U.S. current account deficit and the relatively low level of long-term real interest rates in the world today. The prospect of dramatic increases in the ratio of retirees to workers in a number of major industrial economies is one important reason for the high level of global saving."

Later in the speech he spells this out in more detail:

"one well-understood source of the saving glut is the strong saving motive of rich countries with aging populations, which must make provision for an impending sharp increase in the number of retirees relative to the number of workers. With slowly growing or declining workforces, as well as high capital-labor ratios, many advanced economies outside the United States also face an apparent dearth of domestic investment opportunities. As a consequence of high desired saving and the low prospective returns to domestic investment, the mature industrial economies as a group seek to run current account surpluses and thus to lend abroad"

Now this speech has caused a fair degree of controversy due to the fact that it mainly has been seen as an apologetics for the high US current account deficit (which it - in part - is). But I would also argue that it has a deeper significance, in that this speech marks the arrival on the official agenda of what I would term the New Economic Paradigm: that is the idea that amongst the many important macro economic variables, one, population age structure, has a pride of place whose importance has not been sufficiently appreciated before.

Indeed, when I said Greenspan was being rather coy, I was retaining something up my sleeve, since I am aware that both Greenspan and Bernanke attended this conference at Jacksons Hole last summer where a prominent place was given to this paper from David Bloom, one of the evident 'brains' behind the New Economic Paradigm.

Undoubtedly the principal economic vital statistic for these theorists is the median age of any given population, and the most important information to have on hand when it comes to examining other *dependent* variables (like savings, investment, consumption, balance of payments, fiscal balance, labour force participation or productivity) is the age structure of the population.

Briefly put, what is argued is that each society has a prime saving age (for cultural reasons this may vary from one society to another): in the case of Italy (which we are considering here) this age group appears to be 35-64. The 65 plus age group progressively has more and more tendency to dis-save.

The other salient detail is the location of the 'boom generation': that generation which marks the inflection point in the demographic pyramid. Essentially the passage of this cohort into the dis-saving age group marks an important watershed in the evolution of any modern society.

Now for a specific case: Italy. The Management Consultants McKinsey and Co recently produced a report The Coming Demographic Deficit. You have to register on site to read the full report, but it is free and well worth it.

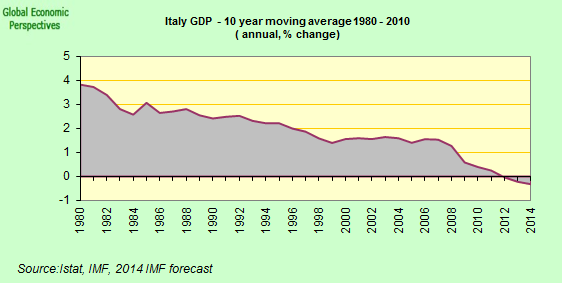

One of the chapters is dedicated to Italy. Below I reproduce the chapter summary which is pretty self-explanatory. The point is, whichever way you look at it the wealth producing capacity of Italy has peaked, and this is why that fiscal deficit is so important, the longer the deficit grows and accumulates, the greater the burden of paying it off. Perhaps before signing off here, and letting you get onto the McKinsey material, I could suggest why *I* think it is that there is so much liquidity, and such strong downward pressure on long term interest rates: simply put, for the reasons Bernanke suggests. Increased savings supply on the one hand, and diminished investment opportunities on the other, demand, side.

"Demographic pressure is expected to continue to drive down Italian household savings flows, further slowing the growth rate of household net financial wealth accumulation, with potentially significant implications for economic growth in Italy. MGI's analysis suggests that ? absent dramatic changes in population trends, savings behavior, or rates of financial asset appreciation ? Italian household savings will decline at 1.7 percent annually over the next two decades, causing a sharp slowdown in the growth of household net financial wealth, from the historical rate of 3.4 percent over the 1986-2003 period to 0.9 percent through 2024. By 2024, this slowing growth will cause net financial wealth to fall some 39 percent, or ?1.8 trillion, below what it would have been had the higher 1986-2003 growth rates persisted".

"The demographic transition has been underway in Italy for the past two decades. Since 1986 the median age in Italy has surged up 7 years, and over the next two decades it is expected to increase another 9 years, reaching 51 in 2024. Italy will have more than an estimated one million people over the age of 90 by 2024."

"With its aging population and the number of working-age households continuing to grow more slowly than elderly households, the demographic structure of Italy will become increasingly less able to support wealth accumulation, a good proxy for economic well-being. Slower growth in wealth is likely to mean slower growth in future living standards. For the economy, there will be less household savings to support a fast-growing retiree population, and it will become more difficult to support domestic investment and sustain strong economic growth. The fact that the rest of the developed world is experiencing or is about to encounter similar aging trends means that Italy cannot rely on inflows of foreign savings to make up for its domestic shortfall."

"To navigate smoothly through this transition and to offset this strong demographic pressure, Italian households and their government will need to take steps to reverse the decrease in saving and to improve the returns that households obtain on their portfolios. Mitigating the demographic forces already at work in Italy will be challenging and will require sustained, coordinated efforts by the public and private sector".

Italy Economy Real Time Data Charts

Edward Hugh is only able to update this blog from time to time, but he does run a lively Twitter account with plenty of Italy related comment. He also maintains a collection of constantly updated Italy economy charts together with short text updates on a Storify dedicated page Italy - Lost in Stagnation?

Tuesday, June 07, 2005

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment