Year on year (and working day corrected) output was down 0.8% over February 2007)Production of Italian consumer goods fell 2.6 percent from January as the output of durable goods like refrigerators declined 0.6 percent with non-durable goods contracting 2.6 percent. The only gain came in energy related goods, which rose 0.5 percent.

Part of the decline in output may have been caused by the plunge in car production, which fell 24 percent from a year earlier on a non-adjusted basis. Istat did not give car output figures compared with the previous month. Production of all vehicles, including trucks and busses, declined 3.2 percent from a year earlier on a non-adjusted basis.

Italy's new car sales fell for a third straight month in March, down 18.76 percent, leading the car industry to blame weaker consumer confidence in light of an election campaign and expectations of slower economic growth. Sales of Fiat's three brands suffered an even harder fall of 20.6 percent.

For the first quarter as a whole the total number of sales registered with the transport ministry was down 10.01 percent at 663,532. The fall was 10.6 percent when taking into account the two extra working days in March 2007, ANFIA said.

Registrations of new car sales totalled 212,326 in March against 261,370 for the same period last year. Those for cars of the three brands belonging to the Fiat group totalled 65,594 against 82,649 in March 2007. Fiat's share of registrations in what is its home market was 30.89 percent.

Its premium sports car brand Alfa Romeo suffered more than the other two brands because its main Pomigliano d'Arco plant was temporarily shut for refitting. Sales of its cars fell 45.90 percent, while those for Fiat were down 16.41 percent and Lancia fell 25.49 percent.

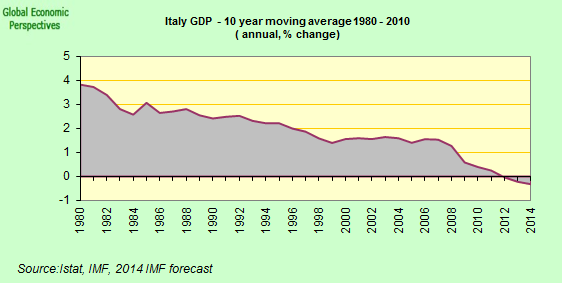

The International Monetary Fund yesterday cut its forecast for Italian growth this year to 0.3 percent, the slowest pace since 2003. Business confidence has slumped to the lowest level in 2 1/2 years and the economy is set to expand less the European Union for a 13th year in 2008, the EU Commission says.

2 comments:

I don't quite understand the 24% (!) fall in car production. While the Italian Market has been slowing a lot (and therefore heavily impacting upon Fiat Auto) sales haven't slowed that much, in Jan Fiat Auto's sales across Europe were pretty much the same as last year (a decline of .3%), in February sales actually rose by 2.5%, though pan European data isn't available for march yet my calculations so far show a fall of about 5.5% for Fiat, 20% for Lancia and 50% for Alfa. And most of the EU10 countries results haven't been posted. So I really find it hard to believe a 24% drop in production. Ferrari, Maserati and Lamborghini have all been posting growth as has Fiat brand, ok the (polish built) 500 has helped a lot (to the tune of c.15,000 units a month) but another star performer has been the Bravo (13,000 units expected in March) and the Croma (4,500 units): both built in Cassino, Italy. Admittedly losing 15,000 units from Pomigliano d'arco can't help, but 24% seems high. Do you have breakdown from each factory? I reckon this is a somewhat odd month, with the Alfa factory just reopened hopefully Aprils figures will look a lot healthier. Plus two big Italian made launches are due soon; firstly the new Lancia Delta, then the Alfa MiTo. Both are expected to shift 80,000 units in 2009. Fiat is enjoying rapid growth in the rest of Europe, hampered mainly by Alfa Romeo. Next year with no fewer than 6 Italian made new launches car production is certain to grow; indeed its one of the few areas of Italian production that is enjoying a strong period

Hi,

Thanks for the comment, and let me say straight of that I am not a car setor analyst, I am only reproducing data which I have found generally published in the responsible financial press.

"Do you have breakdown from each factory?"

So the answer to this is no I'm afraid. The Italian data I cite come straight from press releases of the auto industry association ANFIA.

Sales in many European countries do seem to have tanked in March. I have already mentioned Italy, but in Germany new car registrations fell 14 percent to 286,600 units in March, the VDA auto industry association said last Wednesday.

In Spain, where the economy has been hit hard by a downturn in the housing market, sales fell 15.3 percent in the first quarter and nearly 30 percent in March, according to data from ANFAC, Spain's car makers association.

On the consumption side France is really the only bright spot left in the eurozone, and in many ways is holding the whole thing up at the moment. In March, French car sales went up 9.5 percent when taking into account the extra working days for the month the prior year according to the CCFA French car makers association.

Obviously the position in Eastern Europe and Russia is very different at the present time, with massive consumer booms (which may or may not be sustainable) taking place.

Basically if we look at the quaterly and the March numbers, there does seem to have been a quite strong deterioration between January and March. Italy is, imho, already in recession, Spain is in headlong descent, and Geramn manufacturing is holding up on the basis of exports (the boom in the East) while domestic demand gets into a bigger and bigger mess.

Obviously April may be better than March - since contractions are never completely linear - but I would be expecting worse rather than better to be coming over the next few months.

But as I say, I am a macro economist not an automotive sector specialist, and am just taking car numbers as quite an interesting and useful proxy for general consumption. Of course, in addition, you need to imagine that long term high petrol prices will also take their toll on car consumption, but I imagine access of young people to credit, and their new found need to save given the liquidity problems in buying houses and getting mortgages (which aren't going to go away anytime soon), could be just as important factors.

Post a Comment